in 2017 I’ve worked with EY to develop a set of insurance focused customer vision journeys involving new technologies like fitness trackers, chatbots, AI and social rewards.

My role spanned from research, building up the story flows to prototyping (Flinto) into an interactive presentation. Here is a selection of the end result, around a bit of context for each one.

Story 1: Customer Service Intelligent Automation

Premise

Charles is a customer of ABC Insurance Co and has recently fallen into financial difficulties. After his bank notifies him that he has insufficient funds to pay his premium, he gets in contact with ABC via their mobile app to discuss what to do next. ABC's Al ChatBot, 'Abe', guides Charles through his options to keep his policy from lapsing and actions them immediately for him during their conversations.

Story 2: AI Chat Bot Life Insurance

Premise

Daniel is in the market for life insurance. Through an ABC Insurance Co banner ad, he starts talking to Abe, ABC's Al Chatbot. It offers to help Daniel with his choice resulting in the guided application and purchase of a term life insurance policy with additional riders.

Story 3: Lifestyle Pricing (Apple Watch)

Premise

With a a baby on the way, Nina is interested in a life insurance product that provides protection for her family and rewards her healthy lifestyle. She chats with Kevin, an ABC advisor, who helps her decide and apply.

Persona:

Name: Nina

Age: 26

Occupation: Healthcare worker

Location: London, UK

Personal background:

Nina is a 26-year-old healthcare worker from London who is currently pregnant with her first child. She is an avid exerciser and likes to stay active throughout her pregnancy. Nina is an Apple user and relies on her Apple Watch to track her workouts, monitor her heart rate, and stay connected with her friends and family.

Goals and Motivations:

Nina's main goal is to have a healthy pregnancy and deliver a healthy baby. She is motivated to maintain her exercise routine throughout her pregnancy and wants to make sure that she is getting enough rest and eating a healthy diet. Nina is also interested in learning more about childbirth and parenting to prepare for the arrival of her baby.

Challenges:

One of the main challenges Nina faces is finding the time to exercise and stay active while working long hours as a healthcare worker. She is also concerned about the safety of exercising during pregnancy and wants to make sure that she is not putting herself or her baby at risk. Additionally, Nina is worried about the cost of having a baby and wants to make sure that she is financially prepared for the expenses that come with a new baby.

Values and Fears:

Nina values health, family, and personal growth. She is determined to provide the best possible life for her child and believes that education and healthcare are important for achieving that goal. Nina's biggest fear is that something will go wrong during her pregnancy or delivery, and that she will not be able to provide for her child. She also worries about the impact that the pandemic may have on her baby and her family.

Technology Use:

Nina is comfortable using technology and relies on her Apple Watch to track her workouts and monitor her health during her pregnancy. She also uses her iPhone to stay connected with her friends and family, and to research pregnancy and parenting topics.

Story 4: Lifestyle Rewards via fitness trackers

Premise

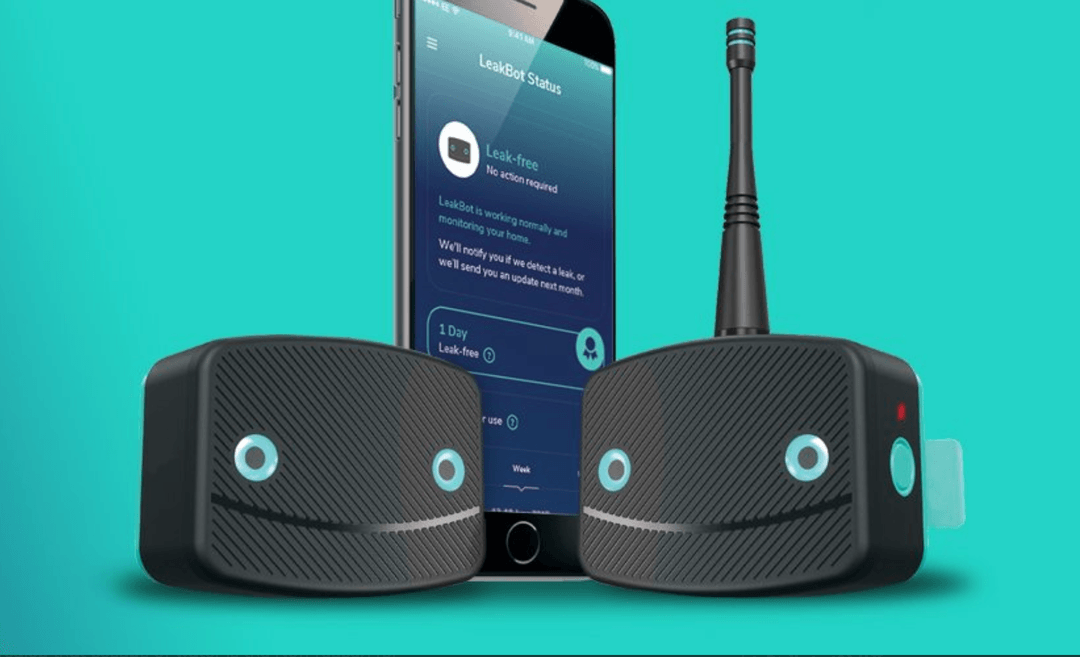

Lynn, an avid sportswoman, posts her excitement about her new fitness tracker to social media. 'Abe', ABC Insurance Co's AI Bot recognises this and notifies her of their lifestyle rewards program. After signing up and syncing her fitness tracker to their mobile app, ABC are informed of her healthy activity while she starts to accrue health points that she redeems for discounts and partner rewards.

Personas

Name: Lynn

Age: 36

Occupation: N/A (assumed)

Location: Manchester, UK

Personal background:

Lynn is a 36-year-old avid sportswoman who lives in Manchester. She loves to stay active and frequently goes on hikes in the surrounding areas. Lynn is excited about her new fitness tracker and loves to post updates and photos about her progress on social media. She values a healthy lifestyle and enjoys trying out new fitness challenges and routines.

Goals and Motivations:

Lynn's main goal is to maintain a healthy and active lifestyle. She is motivated by the challenge of improving her fitness and the sense of accomplishment that comes with setting and achieving fitness goals. Lynn is also interested in connecting with others who share her passion for fitness and enjoys learning new techniques and strategies for staying healthy.

Challenges:

One of the main challenges Lynn faces is finding the time to stay active while juggling her other responsibilities. She is also interested in exploring new areas to hike and workout, but finding safe and convenient locations can be a challenge. Additionally, Lynn is concerned about the cost of maintaining a healthy lifestyle, including the cost of equipment and gym memberships.

Values and Fears:

Lynn values fitness, health, and personal growth. She believes that maintaining an active lifestyle is essential for her physical and mental well-being. Lynn's biggest fear is that an injury or illness will prevent her from staying active and pursuing her fitness goals. She is also concerned about the impact that a sedentary lifestyle can have on her health.

Technology Use:

Lynn is an avid user of technology, and she relies on her fitness tracker to monitor her progress and provide motivation for achieving her fitness goals. She frequently posts updates and photos on social media to share her progress with others and to connect with other fitness enthusiasts. Lynn is also interested in exploring new fitness apps and tools to help her stay motivated and engaged with her fitness routine.

Story 5: Mobile Contributions Annuity Subpayment

Premise

Shane has received a bonus check and wants to make a subpayment to his ABC Insurance variable annuity as a new investment. He initiates the investment process by scanning his check directly to ABC's mobile app. Shane's financial advisor, Marianne, is notified by ABC and she proceeds to facilitate his new investment options.

Persona

User Persona: Shane, 35-year-old IT professional

Demographics:

- Age: 35

- Gender: Male

- Occupation: IT professional

- Income: $100,000 annually

Goals:

- To invest his bonus check in a secure and reliable manner

- To maximize his investment returns with a variable annuity

- To work with a trusted financial advisor to make informed investment decisions

Challenges:

- Limited knowledge and experience in investing

- Limited time to research and manage investments

- Concerned about the risks associated with investing

Behaviors:

- Tech-savvy and comfortable using mobile apps

- Values convenience and efficiency

- Willing to work with a financial advisor to make investment decisions

- Prefer to work with a reputable and established financial institution

Scenario: Shane has just received a bonus check from his employer and wants to invest a portion of it in a variable annuity offered by ABC Insurance. He downloads the ABC mobile app and scans his check directly to initiate the investment process. Marianne, his financial advisor at ABC, receives a notification about Shane's investment and reaches out to him to discuss his investment goals, risk tolerance, and investment options. With Marianne's guidance, Shane is able to make an informed investment decision and feels confident about his new investment in the variable annuity.

Story 6: DNA Heredity Annuity

Charles, a father and grandfather, is advised by his financial advisor, Marianne, to buy ABC Insurance's new DNA Heredity Annuity for his retirement. Based on the length and quality of life his genes may likely give him, the annuity's features help him optimise both his income and lifestyle which benefits not only him but his descendants.

Video presentation

Other Projects

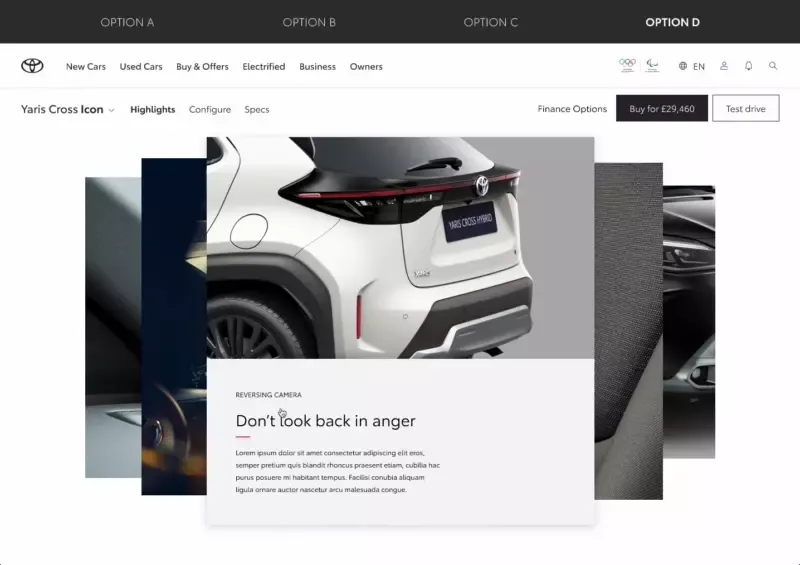

In 2022 I’ve joined Futurice UK in order to help RAC optimise, structure and migrate to a unified design language of their organisation as well user testing and implementing new features.

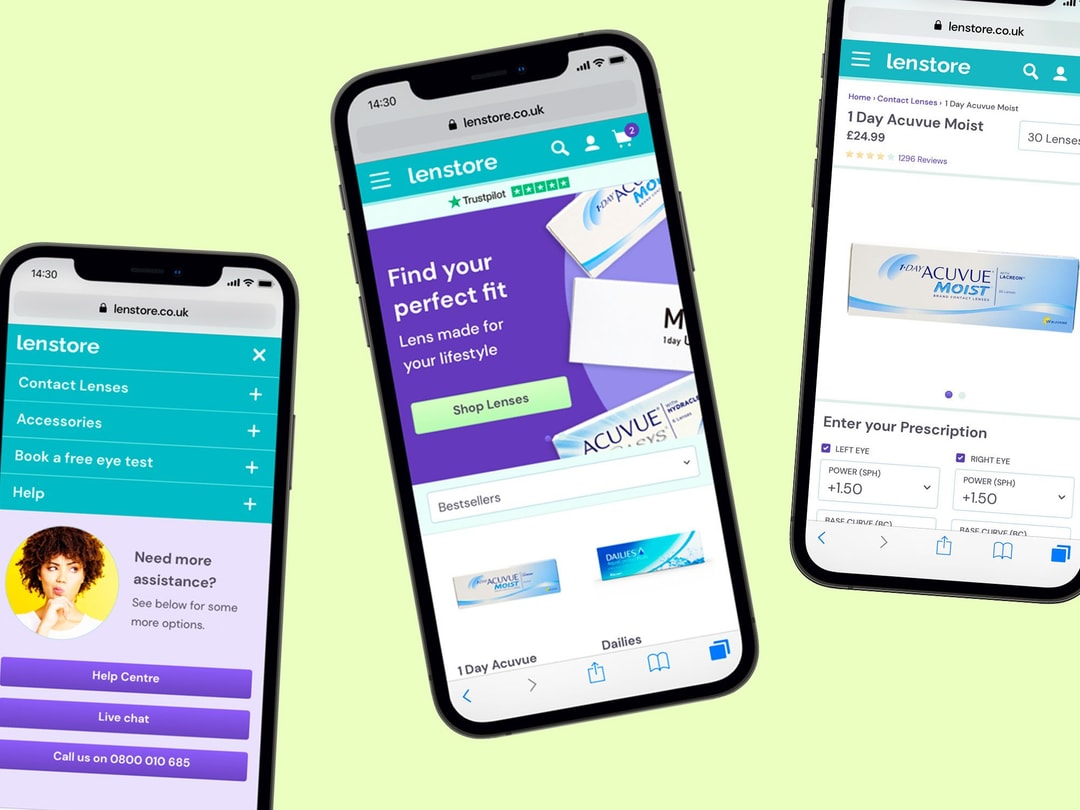

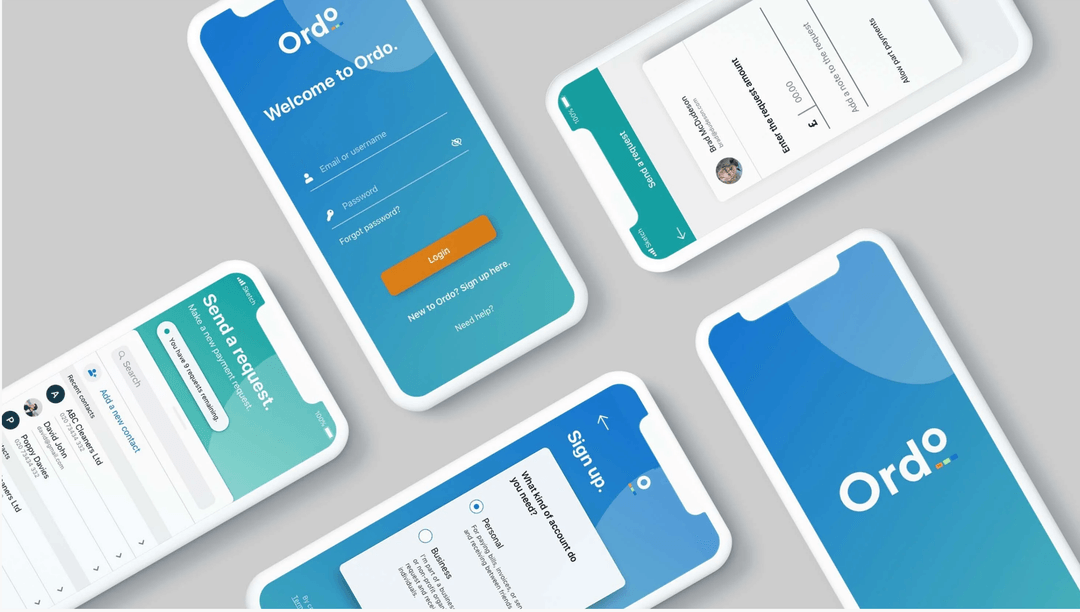

New to the market, Ordo is a groundbreaking payments service for the Open Banking era. Ordo is designed to make it easier for small and medium-sized enterprises to stay in control of their finances - whether they’re collecting customer payments, or paying suppliers.

Citi group created a design team to build advanced trading & wealth management features over the current banking apps to extend with features like asset tracking, cryptocurrencies, stock trading, wealth management, mortgage planning & general wealth advice.

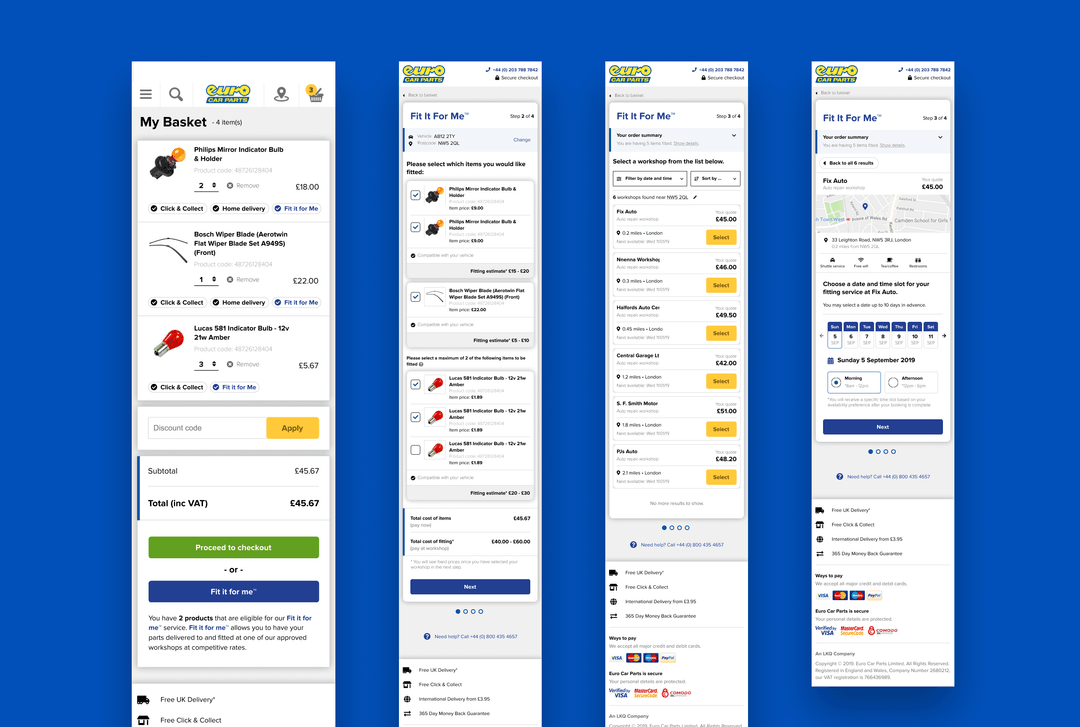

Create “Fit It For Me” service from scratch! A handy service, which lets you buy a selected part, and have it installed by one of our trusted garages

App for Warner Brother's Harry Potter franchise called The Wizarding World. An app that would unify all subbrands and be like an HP universe, a go-to place to find info about your movies, games, quizzes, video trailers and much more.

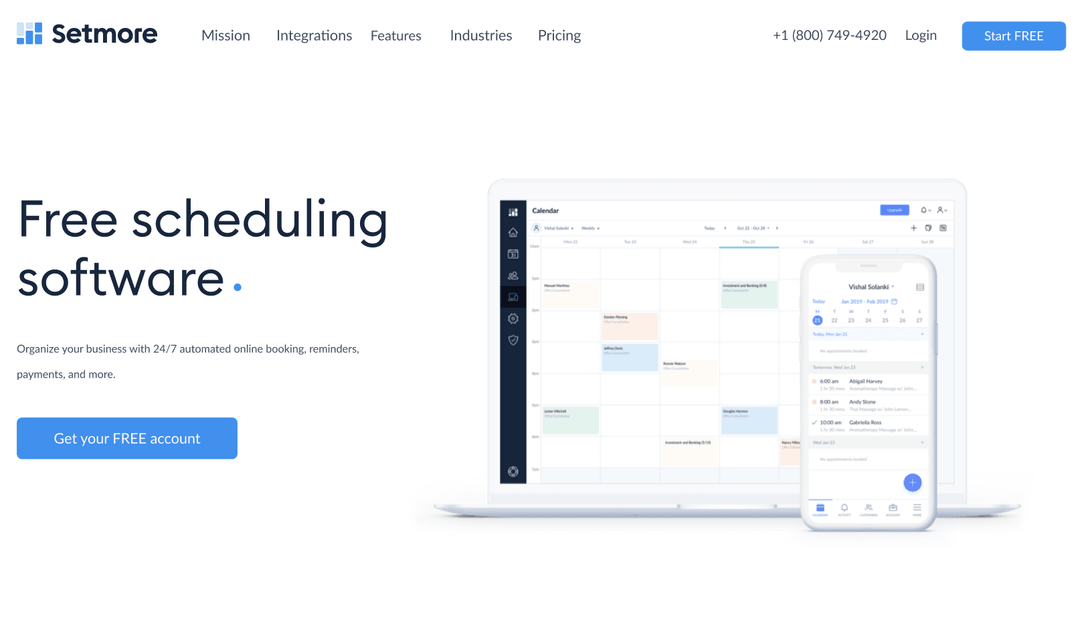

Setmore is part of Anywhere Works suit of products, an array of tools helping businesses to adopt cashless systems and manage customers easily.

![H&M Staff & Store Planner [AKQA]](https://assets.super.so/32c38527-42be-42cb-9c30-60e3398bb786/images/52e0271e-aae3-4aed-8664-090d86d21982/ezgif.com-optimize_(1).gif?w=540)

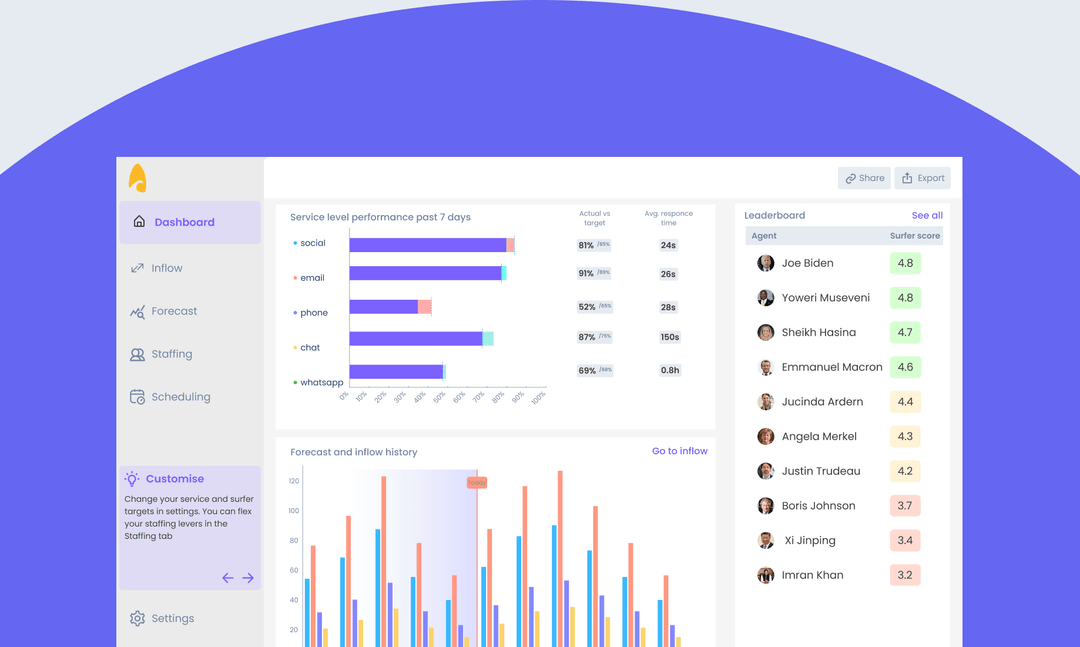

H&M Stafftool concept has been a digital swiss knife like tool, that would replace their paper catalogues which they are currently using to manage stores.

Oxe Fit Design system for their companion app, updates, create hierarchy, create a strategy for the line of devices like the XP1 & XS1

.gif?w=540)

Perfect Play is a training app designed for the consumer market made together with some of the main football couches and sport psychologists from Chelsea FC.

![Peerpoint V2 (Allen & Overy) [Biglight]](/_next/image?url=https%3A%2F%2Fassets.super.so%2F32c38527-42be-42cb-9c30-60e3398bb786%2Fimages%2F82c9ee5c-4532-4bbe-9fac-dd6347480656%2FScreenshot_2019-11-13_at_14.28.52.png&w=1080&q=90)

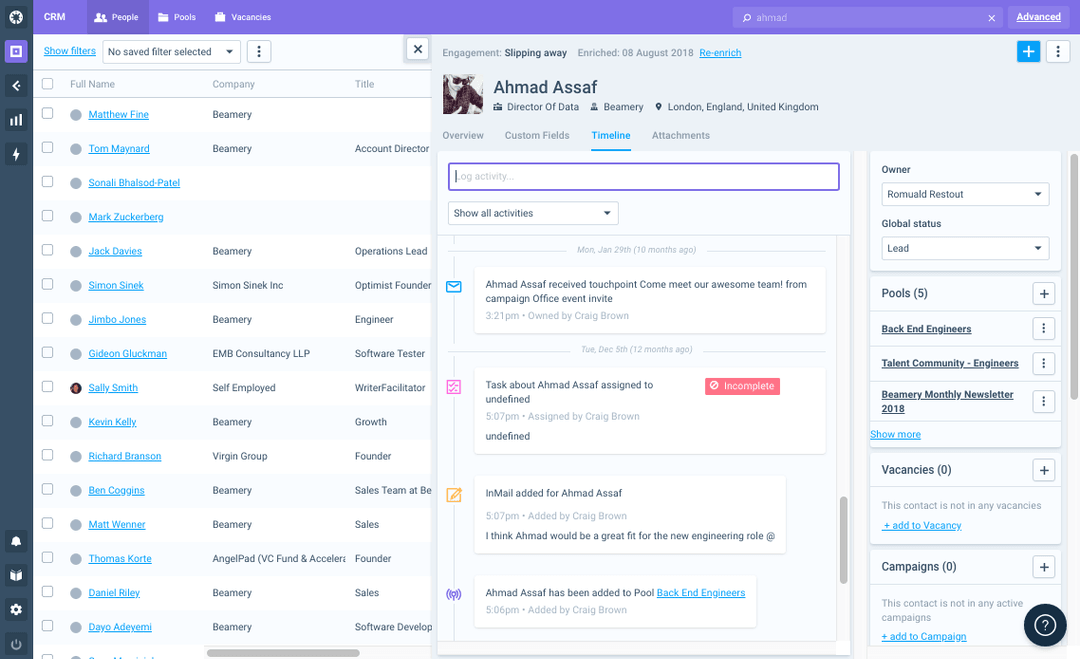

Peerpoint is a platform built by Allen & Overy to manage their recruitment in their law firm. As most of their employees are actually contractors with their own LTD, we had a specific persona model from where we built up the functions